Delve into the world of Home and Auto Insurance Bundle Quotes Explained, where savings and coverage options intertwine to provide a comprehensive insurance solution. Get ready to explore the ins and outs of bundling your home and auto insurance for maximum benefits.

In this guide, we will unravel the complexities of bundle quotes, shedding light on the factors that influence pricing and how policyholders can customize their coverage to fit their unique needs.

Understanding Home and Auto Insurance Bundles

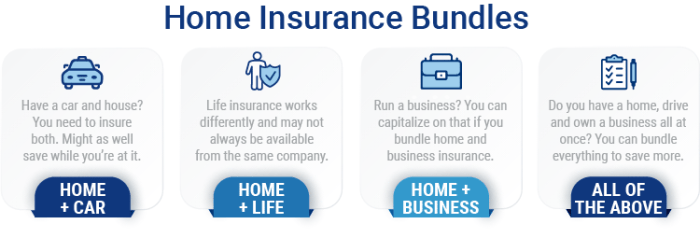

When it comes to insurance, bundling is a popular option for policyholders looking to streamline their coverage. A home and auto insurance bundle involves purchasing both types of insurance from the same provider, often resulting in cost savings and added benefits.

Benefits of Home and Auto Insurance Bundles

There are several advantages to bundling your home and auto insurance policies:

- Discounts: Insurance companies typically offer discounts to policyholders who bundle their coverage. This can lead to significant cost savings on premiums.

- Convenience: Managing both policies with the same insurance provider can simplify the process of filing claims, updating coverage, and communicating with your insurer.

- Increased Coverage: Bundling can sometimes result in increased coverage limits or additional benefits that may not be available with standalone policies.

By bundling your home and auto insurance, you can enjoy financial savings and a more streamlined insurance experience.

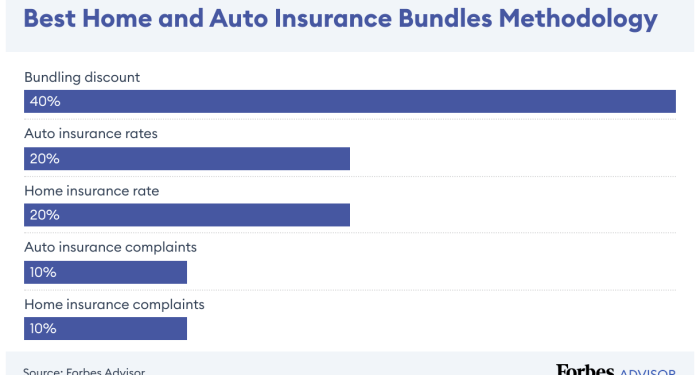

Factors Influencing Bundle Quotes

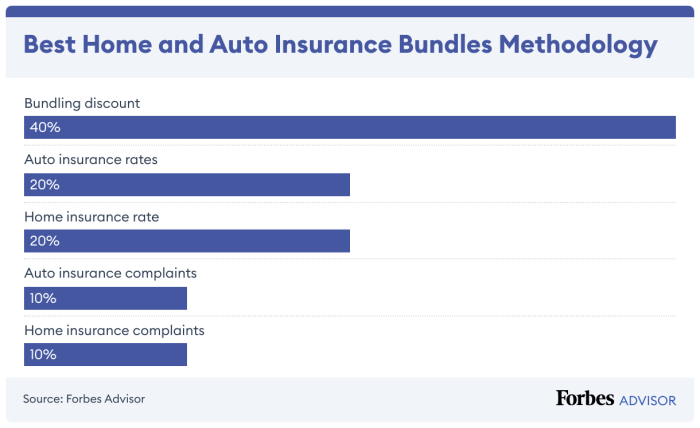

When insurance companies provide bundle quotes for home and auto insurance packages, they take into consideration various factors that can affect the overall cost of the policy. These factors help determine the level of risk associated with insuring both your home and vehicle, ultimately influencing the final bundle quote you receive.

Value of the Insured Assets

The value of your home and vehicle plays a significant role in determining bundle quotes. Insurance companies assess the replacement cost of your home, the make and model of your car, as well as any additional features or upgrades that may increase the value of these assets.

The higher the value of the insured assets, the more expensive the bundle quote is likely to be. Insurers need to account for the potential cost of repairing or replacing these assets in the event of a claim.

Personal Factors Impact

Personal factors such as your credit score and driving history can also have a significant impact on bundle quotes. Insurance companies use this information to assess your level of risk as a policyholder. A good credit score and a clean driving record can potentially lower your bundle quote, as it indicates that you are a responsible individual less likely to file a claim.

On the other hand, a poor credit score or a history of traffic violations may lead to a higher bundle quote, as it suggests a higher risk of future claims.

Customizing Bundle Quotes

When customizing a home and auto insurance bundle quote, policyholders have the flexibility to tailor their coverage to meet their specific needs. By adding on extra coverage options or adjusting deductibles, individuals can create a personalized insurance package that provides the right level of protection for their home and vehicles.

Add-Ons and Additional Coverage Options

- Umbrella Liability Coverage: This additional coverage extends the liability limits of both your home and auto insurance policies, providing extra protection in case of a major lawsuit.

- Rental Reimbursement: Including rental reimbursement coverage in your bundle can help cover the cost of a rental car if your vehicle is in the shop for repairs after an accident.

- Roadside Assistance: Adding roadside assistance to your bundle can provide peace of mind by offering services such as towing, fuel delivery, and lockout assistance.

- Glass Coverage: Opting for glass coverage can help cover the cost of repairing or replacing damaged windows or windshields on your vehicle.

Tailoring Your Bundle

- Adjusting Deductibles: Policyholders can choose higher deductibles to lower their premiums or opt for lower deductibles for more coverage in case of a claim.

- Bundling Discounts: Insurance companies often offer discounts for bundling multiple policies, so policyholders can save money by combining their home and auto insurance.

- Reviewing Coverage Limits: It’s important to review and adjust coverage limits to ensure that your bundle provides adequate protection for your assets and liabilities.

- Customizing Endorsements: Endorsements allow policyholders to add specific coverage options to their bundle, such as coverage for high-value items in their home or extra liability protection on their auto policy.

Comparing Bundle Quotes from Different Providers

When looking to compare bundle quotes from various insurance companies, it is essential to consider more than just the price. While cost is a crucial factor, evaluating coverage limits, deductibles, and exclusions is equally important to ensure you are getting the best value for your insurance needs.

Importance of Looking Beyond the Price

- Consider the coverage limits offered by each provider. A lower price may indicate lower coverage limits, which could leave you underinsured in the event of a claim.

- Examine the deductibles associated with each bundle quote. A higher deductible may result in lower premiums, but you will need to pay more out of pocket in the event of a claim.

- Review the exclusions in the policies. Some providers may exclude certain types of coverage or specific situations, which could impact your decision based on your individual needs.

Tips on Evaluating Coverage Limits, Deductibles, and Exclusions

- Compare the coverage limits for key components such as liability, property damage, and medical payments to ensure you have adequate protection.

- Consider how deductibles impact the overall cost of the bundle quote. A higher deductible can lower your premiums, but make sure you can afford the out-of-pocket expense if you need to make a claim.

- Pay close attention to any exclusions in the policies. Make sure the bundle quote provides coverage for your specific needs and circumstances.

Understanding Policy Terms and Conditions

Insurance policies, including home and auto insurance bundles, are filled with specific terms and conditions that policyholders need to understand in order to make informed decisions. Let’s delve into some common terms found in these policies and their implications.

Deductible

- The deductible is the amount of money that the policyholder must pay out of pocket before the insurance company starts covering the rest of the claim.

- Higher deductibles typically result in lower premiums, but it means the policyholder will need to pay more in the event of a claim.

- Understanding your deductible is crucial as it directly impacts how much you will have to pay in the event of a claim.

Premium

- The premium is the amount of money that the policyholder pays to the insurance company in exchange for coverage.

- Premiums can vary based on factors such as the coverage limits, deductible amount, and the insurance provider’s pricing structure.

- Policyholders should carefully review their premium amounts to ensure they are getting adequate coverage at a price that fits their budget.

Coverage Limit

- The coverage limit is the maximum amount that the insurance company will pay out for a covered loss.

- It is crucial for policyholders to understand their coverage limits to avoid any surprises in the event of a claim that exceeds the limit.

- Policyholders may have the option to adjust their coverage limits based on their needs, but it’s essential to strike a balance between adequate coverage and affordability.

Ultimate Conclusion

As we conclude our journey through Home and Auto Insurance Bundle Quotes Explained, remember that knowledge is power when it comes to making informed insurance decisions. Whether you’re a seasoned policyholder or a newcomer to the world of insurance bundles, understanding the intricacies of quotes and coverage terms is key to securing the best protection for your home and vehicle.

FAQ Guide

What is a home and auto insurance bundle?

A home and auto insurance bundle combines both types of coverage into a single policy, offering convenience and potential cost savings.

How can bundling home and auto insurance save money?

Bundling allows insurance companies to provide discounts for policyholders who purchase multiple policies, resulting in overall lower premiums.

What factors influence bundle quotes?

Insurance companies consider factors such as the value of insured assets, credit score, and driving history when determining bundle quotes.

How can policyholders customize their bundle quotes?

Policyholders can customize their bundle by adding extra coverage options or add-ons to tailor the policy to their specific needs.

How should one compare bundle quotes from different providers?

Effective comparison involves looking beyond the price and evaluating coverage limits, deductibles, and exclusions offered by various insurance companies.

What are common terms in home and auto insurance bundles?

Terms like “deductible,” “premium,” and “coverage limit” are commonly found in insurance bundles and understanding them is crucial for informed decision-making.

![The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai](https://auto.iknpos.id/wp-content/uploads/2026/01/New-Rules-for-Premium-Payments-in-Insurance-120x86.png)

![The [Ultimate 2025 Guide] To Public Liability Insurance In Dubai](https://auto.iknpos.id/wp-content/uploads/2026/01/New-Rules-for-Premium-Payments-in-Insurance-350x250.png)